Rich Dentist Poor Dentist

Daily Break Even Point

The rich dentist understands that the amount your earn minus the amount you spend is what you keep…..

The poor dentist also understands this but fails to take the time to calculate their over head expense. In other words the poor dentists spends more than they make….

If you don’t understand your practices daily BEP or Overhead how do you set goals for production? How Do you ensure you make enough to sustain your lifestyle and pay your bills?

Let’s briefly discuss what a BEP is and then I’ll explain how you can use it.

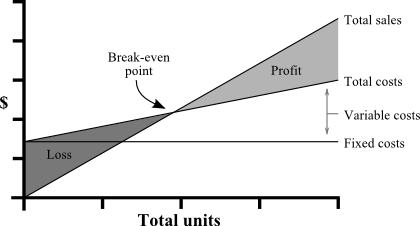

The Break-Even Point is exactly what it sounds like–the point at which your revenue is equal to your expenses.

Even when used monthly, Break-Even provides a ton of usability. Remember earlier when I mentioned that a business cannot survive for long without cash flow? Break-Even is the number EVERY business must achieve to survive.

BEP can also be influenced by managing expenses. When a practitioner finds more efficient use of funds, can buy in bulk or otherwise can effectively reduce expenses, the BEP will drop. In other words, reducing your overhead either through fixed or variable expenses will reduce your Break-Even Point.

The biggest issue I see in so many struggling practices is that the Break-Even is only something used in a business plan, or at best, on an annual basis. I have had tremendous success by using the BEP daily.

This will involve using your Profit and Loss statement (P&L). Take it for a month, and then a quarter, and then over the course of the year in order to gather your data. Ideally, you want a full year of data.

Then ask yourself two questions:

- Is this data accurate for the last year?

- Have I added team members, has my rent increased or have any of my other expenses changed?

Once you have answered yes to the first question and you trust your data then you can work with the second question.

Normalize your P&L for those new expenses so you have an accurate depiction of your annual expenses and calculate the number of days you’re going to be in the chair working. Exclude all Christmas holidays, long weekends, continuing education courses, birthdays, all other holidays, etc. ***(Note: take out expenses that are not actually true business expenses. Things like your car, housekeeper and anything else you are trying to put through your business that is actually a personal expense)

Take your total expenses, both fixed and variable expenses (include your compensation and debt servicing requirements) and divide by the total working days you just calculated. That is your true daily overhead. Coincidentally, that is also your daily break-even point. You can extrapolate your monthly break even point by multiplying this out by total number of days you are working that particular month.

That’s the number you need to bill every day for you to break even. Anything over that number is profit. When you put this into practice, you should have a couple of revelations. You will realize that the daily number seems much more attainable than the annual number. You may also start to recognize how few profitable days your business has.

This simplistic method of calculation applies to most one-provider offices. Complexity in calculation arises with increasing providers and during growth phases of the office. Nonetheless, it can be calculated either way with a little more work.

An alternative method is to calculate your monthly break even point as follows:

Monthly Over-Head (as per P/Ls) + Associate Pay(quarterly or semi-annual average) + Debt Service Payments + Your Compensation as an Owner (set monthly withdrawal if applicable or add yourself to the associate pay component if you pay yourself in the same manner your associates are paid) = Monthly Break Even Point.

***Including your compensation and debt servicing requirements is important. Why? Because your business must earn enough money to actually cover these expenses.

You (or better yet, your office manager or accountant/bookkeeper) should recalculate these figures periodically–monthly, quarterly or annually, whatever interval is right for your business. How often you redraft this report will depend on how often your expenses change, such as when you hire new staff, increase wages or buy/lease new equipment. This is a judgment call on your part. If your overhead doesn’t fluctuate very much, there is no need to waste time (and money) with unwarranted reporting.